Table of Content

How this information affects Fannie Mae will depend on many factors. Changes in the assumptions or the information underlying these views could produce materially different results. The share of rural loans for owner-occupied homes is highest in Midwestern states. Although rural loans are on average more likely to be for manufactured housing, there is a clear geographic concentration of such loans in the South and Southwest. A greater share of rural mortgaged properties have been built in the last decade when compared with urban properties, suggesting that fewer supply constraints exist in these areas. Rural mortgaged properties are more likely to be manufactured housing and second homes, and more likely to have a low appraisal relative to purchase price.

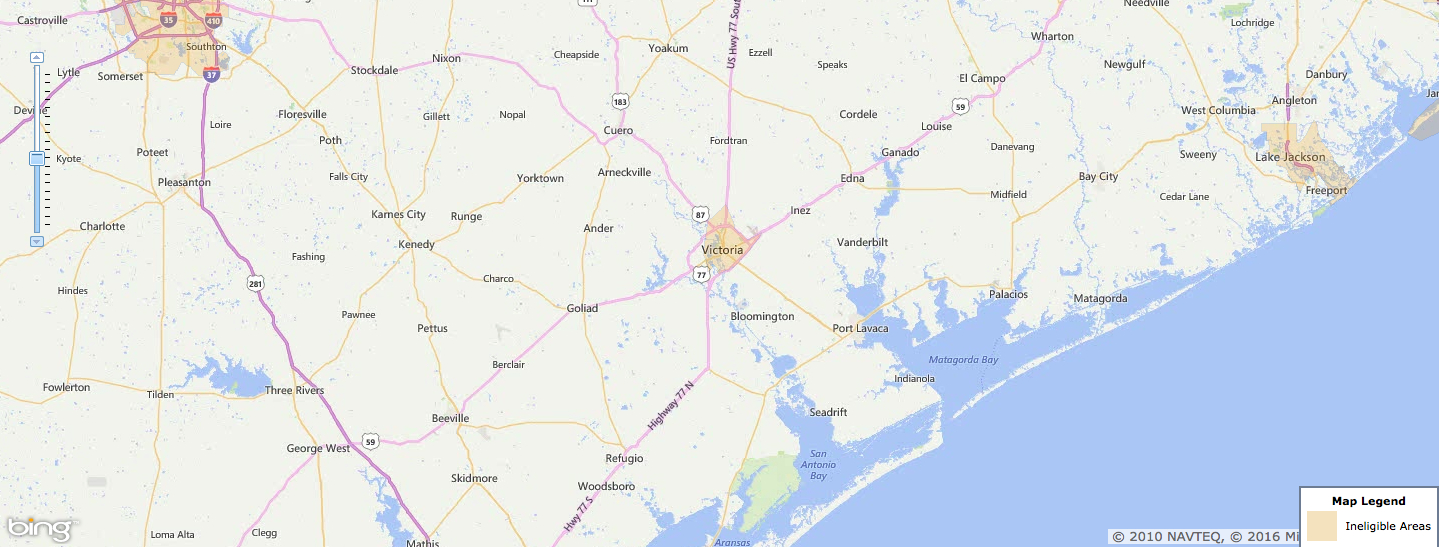

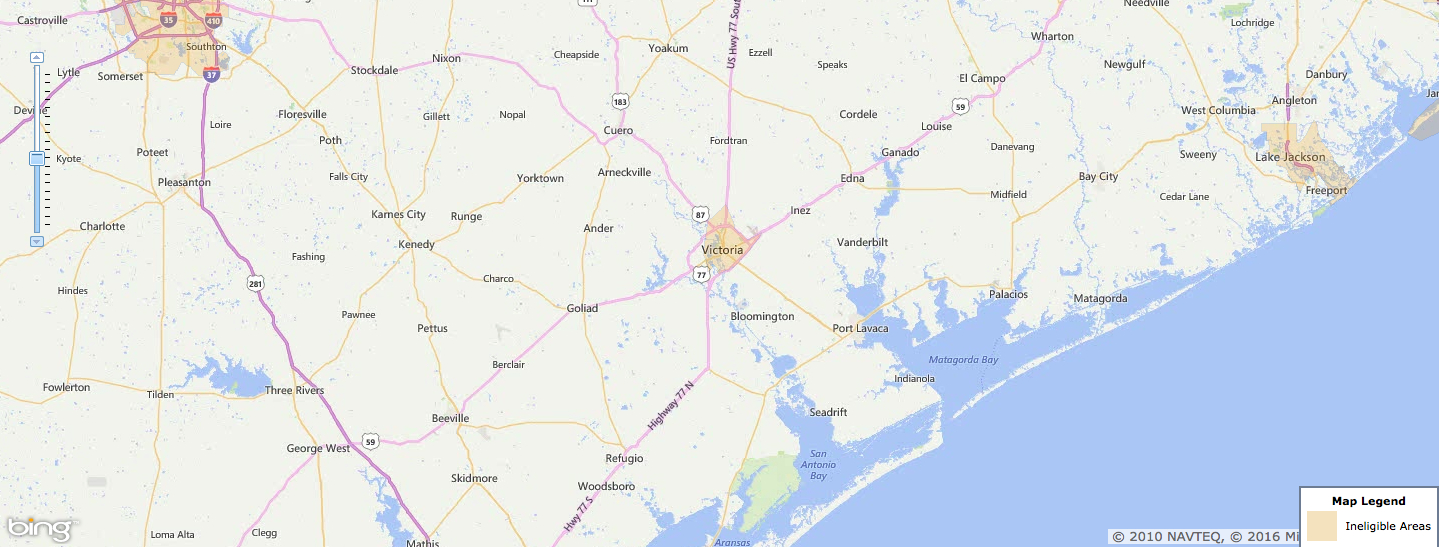

Interested applicants can apply for a Section 502 Guaranteed Loan through USDA Rural Development’s network of approved lenders. These approved lenders are also your point of contact for any questions or scenarios you wish to have reviewed for possible eligibility. Rural markets are unevenly distributed across the U.S. and are more concentrated in less populous states – i.e., rural loans account for a greater share of total mortgage loans in these areas.

USDA Loan Property Requirements 2022

A funded buy down account is where the seller contributes funds to temporarily reduce monthly payments in the beginning of the loan. Another interesting fact is that the funds can be used to pay off installment debt, and even pay off a lease early. If you wish to purchase a home with a USDA loan, there are property requirements that must be met in order for the home to qualify for financing. These include property eligibility based upon the location of the home, as well as certain property types, and appraisal and inspection requirements.

Generally speaking, Rural Development defines a rural area as a city, or community of residence USDA has set household income limits that need to be checked to determine eligibility. To view a detailed list of each state with county limits visit our USDA Home Loan information by state page. Any new construction of a home that will be financed with a USDA rural development loan must meet a number of requirements. It is a rather complex undertaking, and we urge you to not rush into any new construction project without thorough guidance.

Language Assistance

There are only certain standards of homes that are accepted by the USDA for their loan program. However, some townhouses and condominiums may be eligible as well under special circumstances. The biggest eligibility requirement is that your home must be located in an area that this program covers. There are several interactive maps on the USDA website that can pinpoint by state, county, and exact address the eligibility. This means that most towns or cities with 20,000 people or less qualify as rural.

Seller concessions may include all or part of a purchase’s state and local government fees, lender costs, title charges, and any number of home and pest inspections. The USDA Rural Development loan is meant to help moderate to low-income families get access to housing and mortgage loans in some of the less densely populated parts of the country. By enabling homeownership, the USDA helps create stable communities for households of all sizes. USDA loan rates are often lower than conventional 30-year fixed mortgage rates.

USDA loans require mortgage insurance (MI)

Also, the home to be purchased must be located in an eligible rural area as defined by USDA. The other factor to determine eligibility would be the location of the home. USDA Home Loans are available to people who live in rural and suburban communities.

The USDA will have the final say when it comes to approving your home loan, but your local bank or lender handles this as well. This program aims to help individuals who they deem have the greatest need. This can be an individual or a family that currently doesn't have a safe or sanitary home. The families or individuals also can't afford a traditional mortgage or home loan, and their income is below the low-income line for their location. The exact amount varies from state to state, but traditionally you'll need to be at or below 115% of your area's regional income. For example, if your area's average local income is $50,000 per year, you could make a maximum of $ 57,500 annually and still meet the income limit.

USDA Loan Property Requirements

It is critical that you do your research before you apply to make sure you're eligible and that you can prove your eligibility criteria. Your credit is a large factor, and you may have to take time to clean up your credit history as much as you can and check your credit before you apply. This can potentially get you better rates, and it will raise your chances of getting approved. The maximum purchase price will be determined by your debt-to-income ratios which will dictate the maximum monthly payment you are eligible for.

In short, USDA home loans are putting people in homes who never thought they could do anything but rent. To be eligible for a USDA loan you have to meet a few simple requirements. The requirements to be eligible for a USDA loan probably aren’t what you think. Buyers in large cities and more densely populated suburbs aren’t eligible for these loans, but many living in surrounding towns and cities may be.

Or any not-for-profit utility that is eligible to receive an insured or direct loan under such Act. Applicants with assets higher than the asset limits may be required to use a portion of those assets. USDA loans allow for more acres than conventional and FHA loans . There is not an exact number of maximum acres that are allowed, but the land can not exceed more than 30% of the appraised value of the property. The USDA Rural Housing loan is available as a 30-year fixed-rate mortgage only.

Rural Development undertakes these programs to promote rural economic development and job creation projects. • Grants require a 20 percent match from the local utility. Start-up venture costs, including, but not limited to, financing fixed assets such as real estate, buildings, equipment, or working capital.

No comments:

Post a Comment